The rise of neodymium-based permanent magnets represents one of the most consequential material shifts of the 21st century. From powering compact electric motors to enabling high-efficiency wind turbines and precision electronics, these small but powerful components have become central to modern industry, defense, and consumer technology. Their increasing significance touches on economics, geopolitics, sustainability, and technological innovation. This article examines the technical properties that make neodymium magnets indispensable, the evolving supply chain dynamics, the strategic risks and policy responses, and the paths toward greater resilience through recycling and alternative materials.

Fundamental properties and technological role

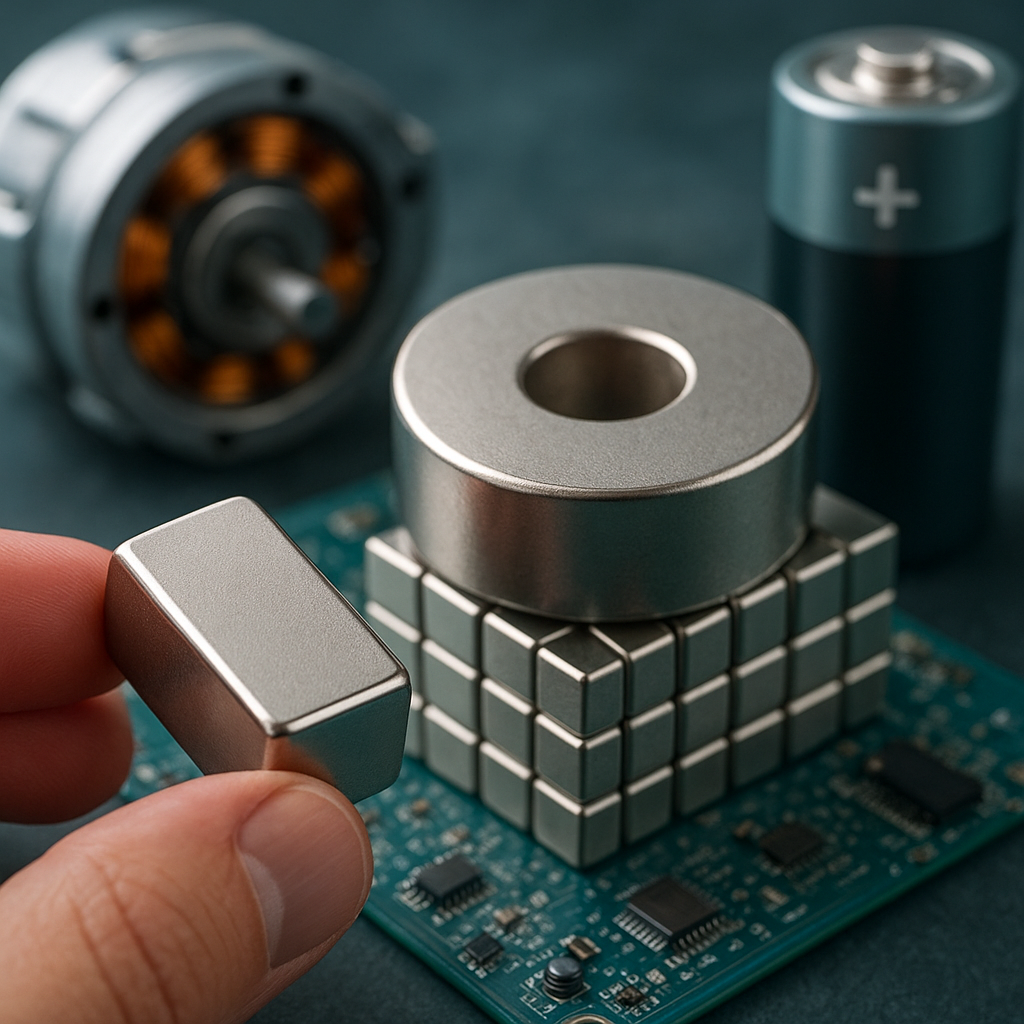

Neodymium magnets, often referred to by the alloy NdFeB, combine neodymium, iron, and boron to create the strongest commercially available permanent magnets. Their exceptional magnetic energy density enables dramatic reductions in size and weight for a given magnetic performance compared with earlier magnet types. That physical advantage underpins a wide range of applications:

- Electric vehicles and hybrid drives, where compact motors deliver high torque and efficiency.

- Wind turbines, particularly in direct-drive designs that omit gearboxes and benefit from strong, reliable magnets in the generator.

- Consumer electronics such as headphones, cameras, and smartphones where miniaturization is critical.

- Data storage devices and computer components that rely on precise magnetic control.

- Advanced defense systems and aerospace components where performance-to-weight ratios are mission critical.

Two magnetic characteristics are especially important: remanence, the strength of the magnetic field that remains after magnetization, and coercivity, the resistance to demagnetization. NdFeB magnets offer high values of both, making them ideal for high-performance, compact designs.

Supply chain realities and geopolitical implications

The term rare earths describes a group of 17 elements that include neodymium and praseodymium, which together provide the primary magnetic material components known as NdPr. Despite the name, these elements are not uniformly rare in the earths crust, but their economic extraction and refining are concentrated. Over recent decades, China has come to dominate almost every stage of the rare earths supply chain, from mining to advanced processing and magnet production. This concentration creates several strategic vulnerabilities:

- Market leverage for producing countries that can affect global prices and availability.

- Risks of export restrictions or production cutbacks during geopolitical tensions.

- Environmental and regulatory constraints that complicate the opening of new mines elsewhere.

Governments and companies worldwide are increasingly conscious of these risks. Policies now focus on diversification, onshoring, and investment in alternative sources. Examples include new mining projects in Australia, the United States, and other regions, as well as investments in separation and refining capacity outside China. Industrial strategies also consider stockpiling critical materials and establishing long-term off-take agreements to reduce short-term exposure to supply shocks.

Market trends, demand drivers, and economic impact

Demand for NdFeB magnets is rising rapidly, driven primarily by the electrification of transport and the expansion of renewable energy generation. Projections suggest that the global market for permanent magnets will grow sharply over the next decade as electric vehicle adoption accelerates and grid-scale renewables expand. Key economic and industrial implications include:

- Upstream price volatility for NdPr oxides, which influences the cost structure of EVs and wind turbines.

- Incentives for manufacturers to design with reduced magnet content or to substitute materials where possible.

- Increased vertical integration as manufacturers seek control over raw material sources.

Industry winners will be those able to manage raw material risk, integrate recycling and secondary supply chains, and leverage innovation to extract more performance or reduce dependence on scarce elements.

Environmental footprint and social considerations

Mining and processing rare earths pose environmental challenges. Extraction can create substantial land disturbance, waste streams containing residual radioactivity, and chemical effluents if not managed correctly. The refining stage is especially energy- and chemical-intensive. These impacts have historically driven production to jurisdictions with lower regulatory costs, which is one reason for the current geographic concentration of processing capacity.

Addressing environmental issues requires a combination of regulatory standards, improved processing technologies, and corporate environmental responsibility. Emerging techniques aim to reduce water and energy use, limit hazardous byproducts, and implement more responsible tailings management. A commitment to recycling and circular material flows can significantly lower the lifecycle environmental burden of neodymium magnets by reducing the need for primary ore extraction.

Recycling, circular economy, and material efficiency

Recycling end-of-life magnets and recovering NdPr from electronic waste and industrial scrap is a growing priority. Effective recycling pathways can blunt supply risks and reduce environmental harm. Current recycling approaches include:

- Direct re-magnetization and refurbishment of intact components.

- Hydrometallurgical and pyrometallurgical processes to extract rare earth oxides.

- Innovative solvent extraction and selective leaching techniques that improve recovery rates.

Operational challenges remain, including the dispersed nature of magnet-containing products, impurities introduced during use, and the economics of collection and processing. Policy mechanisms such as extended producer responsibility, incentives for design for disassembly, and investment in recycling infrastructure are crucial to scale secondary supply.

Alternatives and technological responses

Given the strategic exposure associated with NdFeB dependence, research efforts pursue both alternative materials and design approaches. Two broad paths are evident:

Material-level substitutes

- Samarium-cobalt magnets offer higher temperature stability and corrosion resistance, but they are more costly and less energy-dense than NdFeB.

- Research into iron-nitride and manganese-based magnets aims to reduce reliance on rare earth elements, though these materials currently lag behind NdFeB in performance.

Design and system-level innovations

- Electric motor architectures that reduce magnet content through improved electromagnetic design, such as switched reluctance motors or induction motors with enhanced power electronics.

- Hybrid systems that combine permanent magnets with electromagnetic windings to lower overall rare earth usage without sacrificing efficiency.

- Advanced manufacturing techniques like additive manufacturing that optimize magnet shape and material distribution.

While alternatives and design changes can reduce demand for neodymium magnets in specific applications, many high-performance use cases will continue to favor NdFeB for its unmatched power density. Therefore the realistic strategy is diversified: support for substitutes and efficiency improvements alongside secure and sustainable NdFeB supply.

Policy, industry strategy, and international cooperation

Recognizing the strategic nature of neodymium magnets, policymakers are deploying a mix of tools to strengthen resilience:

- Financial incentives and grants to develop domestic mining and refining capacity.

- Trade agreements and international partnerships to diversify supply chains and share best practices for environmental management.

- Standards and procurement policies that favor verified low-impact sources and recycled content.

Industry strategies include diversifying supplier relationships, investing in recycling and material recovery, and pursuing joint ventures to build refining and magnet manufacturing capacity in multiple jurisdictions. Public-private collaboration is essential to bridge the capital-intensive gap between discovery and commercial-scale production, while ensuring socially and environmentally responsible operations.

Strategic risks and resilience measures

Several risk vectors demand attention:

- Supply concentration that enables abrupt policy or market shifts.

- Price volatility that affects strategic industries such as automotive and renewable energy.

- Technological lock-in that could raise transition costs if alternative materials or designs mature quickly.

Resilience measures emphasize redundancy, strategic stockpiles, investment in research for substitutes, and scaling recycling systems. Firms that proactively adapt procurement and product design are better positioned to navigate future disruptions.

Future outlook and innovation frontiers

Over the coming decade, the intersection of decarbonization goals and technological progress will keep demand for high-performance magnets high. Key trends to monitor include improvements in magnet recycling economics, breakthroughs in low-rare-earth magnetic materials, and the geopolitical reshaping of supply chains through diversified investment. Continued innovation in materials science, combined with coordinated policy responses and industry action, can transform a point of vulnerability into an area of strategic opportunity. The growing importance of neodymium magnets is thus not just a technical matter but a cross-cutting challenge that links industry competitiveness, national security, and environmental stewardship.