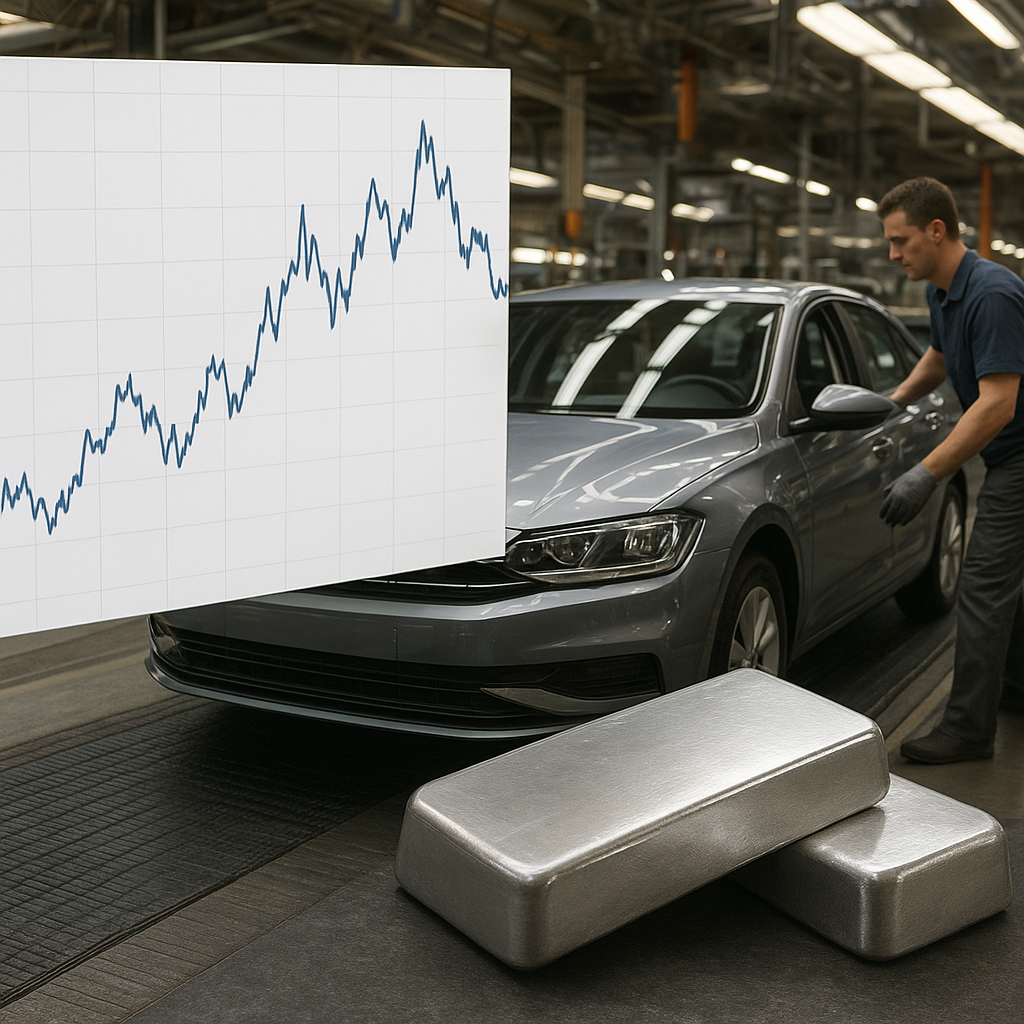

The global market for platinum group metals has long been a niche domain where small shifts in supply or policy can ripple into substantial price movements. Among these metals, rhodium stands out for its extraordinary value and sensitivity to market forces. This article examines the causes behind rhodium price fluctuations and the consequent effects on the automotive industry, exploring production constraints, regulatory drivers, recycling dynamics, and investment behavior that together shape one of the most volatile commodity markets today.

Understanding Rhodium and Market Dynamics

Rhodium is one of the six PGMs and is primarily used in catalytic converters to reduce harmful emissions. Its physical scarcity and highly concentrated mining geography create a market that is both thin and prone to rapid price swings. While gold and oil are traded with deep, liquid markets, rhodium often changes hands in smaller volumes and through specialized intermediaries, amplifying the impact of single large transactions or supply disruptions.

Supply Characteristics

- The majority of rhodium is co-produced from nickel and platinum group metals miners in Southern Africa, with supply dominated by a few large mines and refiners.

- Because rhodium is a by-product, its availability does not respond directly to rhodium price signals; it is tied to the economics of mining primary metals like nickel and platinum.

- Geopolitical risks, strikes, and operational challenges at a handful of key operations can create sudden contractions in physical availability.

Demand Drivers

Demand is mostly industrial and heavily influenced by automotive EU, US, and Chinese emissions standards. As regulations tighten, automakers increase the amount of rhodium in catalytic systems, elevating global consumption. Additionally, the metal has niche uses in chemical catalysts, glass manufacturing, and electronics, but the automotive sector remains the dominant end market.

Price Volatility: Causes and Historical Episodes

Rhodium’s volatility has produced headline-grabbing price surges and dramatic falls. Prices reached extraordinary highs in the mid-2000s and again experienced spikes during periods of constrained supply. Because trading volumes are limited, expectations and speculative flows can have outsized effects.

Key Factors Behind Fluctuations

- Concentration of production: A strike or decline in a few mines can disproportionately tighten global availability.

- Regulatory shifts: Rapid implementation of stricter emissions rules increases automotive demand quickly.

- Technological substitution: Advances that change the ratios of PGMs in converters or allow for alternative metals reduce or reallocate demand.

- Recycling rates: Because used converters are a major secondary source, recycling collection and processing efficiency materially affect supply.

- Investor behavior: Investors and funds seeking exposure to rare metals can amplify price trends when entering or exiting the market.

Historical Examples

Several notable episodes illustrate these dynamics: mid-2000s surges linked to industrial expansion and rising automotive demand; post-2008 volatility tied to global economic shifts; and more recent spikes connected to supply chain disruptions and increasing emission standards in major auto markets. Each event showed how narrow market structures and concentrated demand drivers can produce rapid, large-magnitude price moves.

Impact on the Automotive Industry

Automakers are at the forefront of both causing and responding to rhodium price movements. As regulators demand lower tailpipe and NOx emissions, carmakers adjust catalytic formulations, often increasing the amount of rhodium per converter. This creates direct cost implications and strategic shifts across the supply chain.

Cost Pressures and Vehicle Pricing

When rhodium prices surge, the automotive sector faces higher component costs. Original equipment manufacturers (OEMs) have several responses:

- Passing costs to consumers as higher vehicle prices, which can affect sales volumes and market competitiveness.

- Redesigning catalytic converters to use different PGM ratios or improve material efficiency.

- Negotiating long-term supply contracts or strategic partnerships with refiners to secure stable supplies and predictable pricing.

Because rhodium constitutes a small weight fraction but a large value share of the converter, even modest formulation changes can significantly affect margins.

Supply Chain and Strategic Responses

Automakers and suppliers are deploying a mix of tactical and strategic solutions to manage rhodium exposure:

- Material optimization: Engineers work to reduce PGM loading while maintaining emissions performance, sometimes substituting more abundant PGMs where possible.

- Supplier diversification: Firms seek to broaden their pool of catalyst suppliers and invest in closer supplier relationships to mitigate single-source risks.

- Recycling initiatives: Increasing the collection and processing of end-of-life catalytic converters provides a valuable secondary supply stream.

- Hedging and procurement: Some larger OEMs hedge PGM exposure or enter into forward purchase agreements to smooth costs across production cycles.

Recycling, Technology, and Regulatory Influence

Secondary supply through recycling plays a crucial role in stabilizing the rhodium market. Efficient collection of end-of-life vehicles and advanced refining recover significant amounts of PGMs, buffering some of the shocks from primary production.

Advances in Recycling and Recovery

- Improved converter dismantling techniques and urban mining projects increase recovery rates of rhodium from scrapped vehicles.

- Refiners invest in more precise extraction processes to maximize recovery and reduce environmental footprint, making recycled rhodium more cost-effective.

- Policy incentives and extended producer responsibility laws in some regions encourage better end-of-life management and increase recycled flows.

Technological Alternatives and R&D

R&D efforts aim to reduce reliance on rhodium without compromising emissions control:

- Catalyst design seeks lower-PGM formulations and coatings that achieve the same catalytic activity with less precious metal.

- Emerging technologies, such as advanced sensor integration and optimized engine calibration, can reduce the catalytic burden by minimizing pollutant formation upstream.

- Electrification trends shift long-term demand dynamics—battery electric vehicles (BEVs) eliminate the need for exhaust catalysts entirely, while hybrids and fuel cells create different PGM profiles.

Regulatory Pathways

Strict emissions standards act as a major demand accelerator for rhodium, but regulations can also drive innovation. For example, phased-in limits give automakers lead time to adapt catalyst designs or scale procurement. Conversely, rapid unexpected regulatory changes can strain supplies and produce short-term price spikes. Policymakers balance public health goals with economic impacts, sometimes offering transition periods or incentives to ease industry adjustment.

Investment and Market Sentiment

Beyond industrial consumption, market participants increasingly view rhodium as a speculative asset. Due to its high value per unit mass and limited trading infrastructure, investor flows can distort fundamental price signals. Funds, private investors, and even strategic stockpiling by industry players contribute to cyclical price behavior.

Market Structure and Liquidity

Rhodium lacks the extensive derivatives markets that exist for other commodities, which limits the tools available for hedging. This thin liquidity means that large purchases or sales can move prices sharply. In response, some market participants hold physical inventories or use over-the-counter agreements with refiners to manage exposure.

Strategic Holding and Geo-economic Considerations

National interests and corporate strategies sometimes lead to hoarding or strategic reserves. Given the metal’s importance for environmental compliance and its concentration in particular regions, governments and major industrial players may seek to secure supplies to protect manufacturing continuity. Such actions can further constrain the market and create geopolitical sensitivities.

Practical Implications for Stakeholders

Different stakeholders face distinct challenges and opportunities arising from rhodium price behavior:

- Automakers: Need to balance emissions targets, cost management, and supply resilience through design innovation and procurement strategies.

- Suppliers and refiners: Can invest in recycling and processing to capture value from secondary sources and stabilize margins.

- Investors: Must recognize the thin market dynamics and elevated risk profile of rhodium relative to more liquid commodity exposures.

- Regulators: Can smooth industry transitions by providing predictable timelines and encouraging circular economy practices that bolster recycled supply.

Recommendations and Forward-Looking Considerations

To mitigate the disruptive effects of rhodium price swings, a combination of strategies is advisable: diversify sourcing, ramp up recycling and circular economy measures, invest in catalyst efficiency R&D, and implement procurement instruments that reduce short-term exposure. Monitoring technological trends—particularly electrification rates and advanced catalyst designs—will be essential for anticipating medium- to long-term demand shifts.

As the automotive landscape evolves, the interplay between environmental policy, technology, and the unique economics of rhodium will continue to shape both prices and industrial strategies. Stakeholders who proactively engage with these dynamics will be better positioned to navigate volatility while meeting regulatory and market demands.