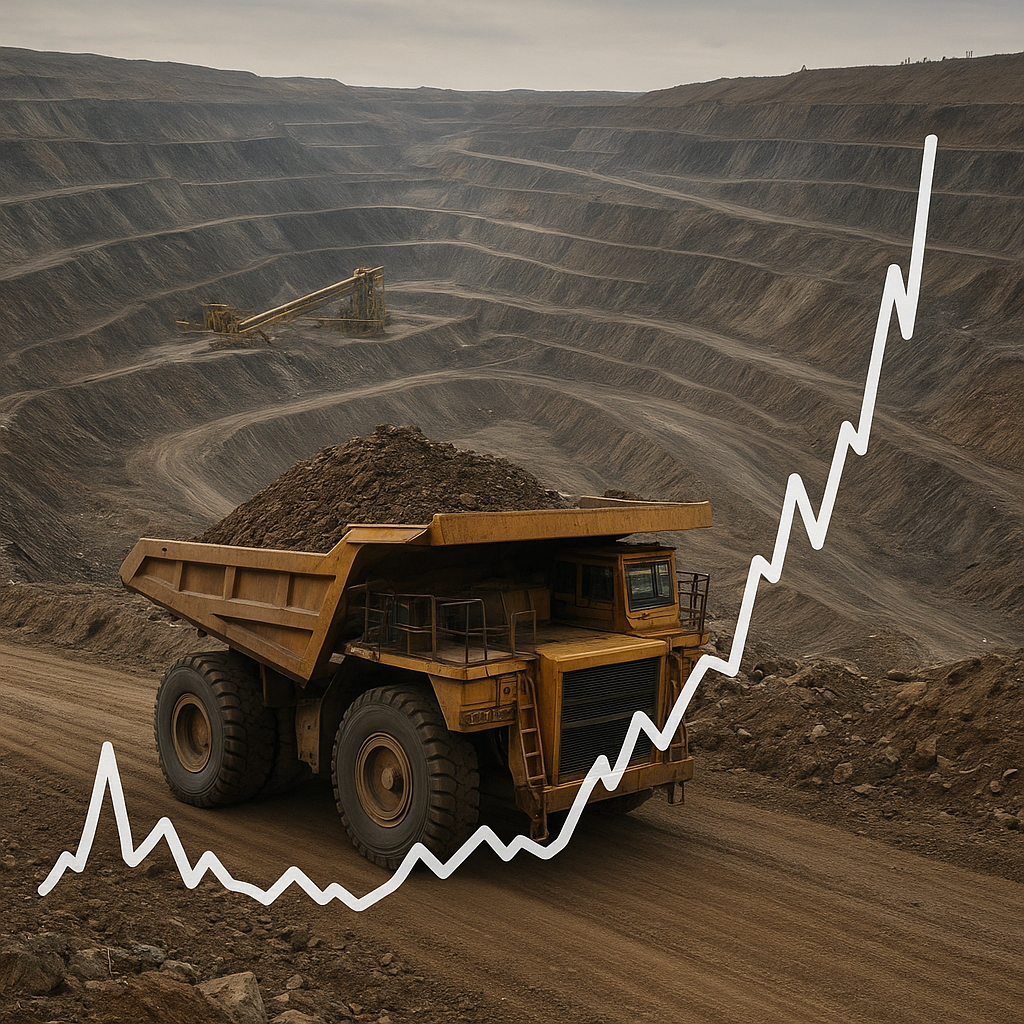

The mining industry is uniquely sensitive to commodity cycles. When sudden price spikes occur they can trigger a chain of decisions that reshape the trajectory of mine development for decades. This article examines how transient market shocks interact with geological realities, capital constraints, regulatory environments and corporate strategy to influence long-term outcomes for mines, host communities and global supply chains. It also outlines practical approaches mine operators and policymakers can use to reduce risk and convert short-term windfalls into durable value.

Market dynamics and the mechanics of price spikes

Commodity markets are driven by demand-supply mismatches, speculative flows, geopolitical events and macroeconomic shifts. A sudden surge in demand — for example from a new technology or an industrial boom — or a supply disruption — such as a strike, natural disaster, or export restriction — can produce sharp price movements. The immediate effect is often an incentive to accelerate production, but the longer-term implications depend on the type of commodity, the time needed to bring new capacity online, and the flexibility of existing operations.

Elasticities and reaction time

Most base metal and energy projects are characterized by low short-term supply elasticity. In other words, production cannot be ramped up quickly without significant capital and time. Mines often require years of permitting, engineering and capital mobilization before additional output materializes. That lag means a temporary market spike may not be matched by a corresponding increase in global production, preserving high prices but also increasing volatility as new projects are evaluated.

Speculation, inventories and signaling

Inventories and speculative positions can amplify spikes. Traders and consumers react to price signals: high prices prompt stockpiling, substitution, or aggressive hedging, each of which feeds back into the price discovery process. For miners, these signals are both an opportunity and a risk: elevated prices may justify pursuing marginal deposits, but they can also mislead decision-makers if the spike proves short-lived.

How spikes affect long-term mine development decisions

When prices jump, management teams must decide whether to treat the event as a temporary aberration or a new structural baseline. This decision shapes exploration priorities, expansion plans, financing strategies and operational approaches.

Accelerated expansions and the risk of overbuilding

High prices make marginal projects economically attractive. Companies often respond by fast-tracking expansions, increasing exploration spending, or re-opening previously idled operations. While expansion can capture higher margins, it also carries risks: if price uncertainty persists and capital is deployed based on inflated expectations, the industry can face an oversupply cycle later. Overbuilding leads to stranded assets, impairments and lost shareholder value.

Deferred projects and preservation strategies

Conversely, some firms choose to conserve cash and prioritize high-return brownfield opportunities. They may invest in efficiency upgrades, extend mine life by optimizing waste stripping and stockpile management, or pursue selective exploration targeting higher-grade zones. These approaches tilt short-term profits toward long-term sustainability, preserving value when cyclical downturns occur.

Technology, process improvements and productivity

Price spikes often free up funds for innovation. Companies can invest in automation, better ore-sorting, and process metallurgy to lower operating costs and improve recovery. Such investments have enduring benefits: they reduce the marginal cut-off grade, extend reserves and make mines more resilient to future price volatility.

Financial and contractual responses

How mines are financed and how they contract with suppliers and buyers determine the durability of decisions made during spikes.

Hedging, offtake and revenue management

Firms with prudent hedging programs can lock in gains without committing to irreversible expansion. Long-term offtake agreements provide revenue certainty, which eases access to debt and lowers weighted average cost of capital. However, overly conservative hedging during a genuine structural shift may leave producers under-exposed to upside, while aggressive exposure can magnify downside risk.

Financing structures and capital allocation

Price spikes often unlock financing windows — banks and equity markets are more willing to underwrite mining projects when outlooks look favorable. Yet the structure matters: equity-financed projects shift risk to shareholders, while debt-financed growth requires steady cash flows. Firms that match financing tenor and covenants to project life-lines reduce the chance of forced asset sales if prices revert.

Regulatory, social and environmental consequences

Spikes can accelerate the pace at which mines develop, putting pressure on regulators and communities. Rapid expansions may outpace environmental assessments, infrastructure planning and social negotiations, increasing the risk of conflict and permitting delays that ultimately delay production and add costs.

Community expectations and social license

Sudden inflows of investment and jobs can raise local expectations for lasting benefits. If communities perceive that expansions are temporary or that profits leave the region, social opposition can harden. Conversely, transparent benefit-sharing, local hiring commitments and visible investments in services can convert a price windfall into durable social license.

Regulatory adaptation and fiscal policy

Governments often respond to commodity booms by revising royalty schemes, taxes or local content rules. Well-designed fiscal instruments — such as countercyclical royalties or sovereign wealth contributions — can capture some upside for the public good while avoiding disincentives to investment. Poorly timed or retroactive policy shifts, however, deter long-term development.

Strategic frameworks and tools for decision-makers

Given the complexity, mining companies and policymakers benefit from frameworks that balance opportunism with prudence.

Value-preserving principles

- Use scenario analysis and stress testing to evaluate expansions under multiple price paths.

- Prioritize investments that improve long-term margins (technology, processing, recovery) rather than only those that boost short-term tonnage.

- Structure contracts and financing to align payback periods with project life and commodity cycles.

- Maintain a disciplined exploration portfolio: balance near-mine brownfield work with high-potential greenfield targets.

- Embed flexible mine designs that allow modular scale-up or scale-down in response to market signals.

These measures, combined with robust governance, help ensure that temporary price advantages translate into sustained value rather than fleeting gains followed by painful corrections.

Case examples and lessons learned

Historical booms in commodities such as copper, lithium and coal illustrate recurring patterns. During the early 2000s copper boom, many projects were rushed; several suffered cost overruns and timeline slippages when prices fell. In contrast, some lithium producers used surge revenues to invest in processing capacity and downstream integration, securing stronger positions during subsequent demand growth. The contrast highlights the importance of directing boom-period cash into investments that improve competitive positioning rather than short-lived volume expansion.

Across cases, successful actors shared common traits: disciplined capital allocation, conservative long-term planning, investment in technology that reduced unit costs, and active engagement with stakeholders to manage social and environmental impacts.

Policy recommendations for host governments

Policymakers can shape whether spikes lead to sustainable development:

- Create fiscal frameworks that capture windfalls for public investment without deterring private investment.

- Invest in permitting capacity and infrastructure to reduce bottlenecks when demand surges.

- Promote transparency and local benefits to preserve social stability during rapid development phases.

- Support geological and geospatial data initiatives to reduce exploration risk and attract high-quality investment.

By aligning public policy with market incentives, governments can turn sporadic price booms into lasting improvements in national value generation.

Concluding considerations for stakeholders

Price spikes are double-edged. They create opportunities to accelerate growth, finance innovation and unlock previously uneconomic resources. But they also tempt rushed decisions that increase long-term risk. Mining firms that combine disciplined financial strategy, flexible operational design and targeted investments in productivity and exploration are best placed to transform temporary market gains into durable competitive advantage. Equally, governments that design measured fiscal responses and invest in enabling infrastructure can capture more public good from boom periods while maintaining a stable investment climate. Ultimately, the ability to distinguish between transient volatility and structural change—and to act accordingly—determines whether a spike becomes a springboard or a trap.