The long-term outlook for the lithium carbonate market is shaped by a complex interplay of technological trends, policy choices, extraction capacity, and global economic forces. As the backbone chemical for many lithium-ion batteries, lithium carbonate will remain central to the energy transition, yet its role and value will evolve as new chemistries, recycling systems, and regional strategies develop. This article examines the core drivers, likely scenarios, and risks that will define the market over the next decade and beyond.

Fundamental drivers: demand, supply and price dynamics

On the demand side, growth is primarily driven by electrification of transport and expanding stationary storage deployments. The adoption of EVs continues to accelerate in many markets due to stricter emissions policies, consumer incentives, and improvements in vehicle range and affordability. Beyond transport, grid-scale and behind-the-meter storage add incremental demand for high-quality lithium chemicals. Demand for lithium carbonate specifically depends on battery chemistry choices: some manufacturers prefer lithium carbonate, while others opt for lithium hydroxide based on cathode formulations.

Supply is determined by geology, processing capacity and the pace of investment. The two main extraction routes—brine evaporation from salt flats and hard-rock spodumene mining—have very different production profiles, lead times and environmental footprints. Large new investments in Australia, South America and parts of Africa have expanded global supply, but bringing new projects online can take years and faces regulatory and community hurdles.

These dynamics produce pronounced price cycles. Lithium markets have historically shown steep rises during periods of tightening and sharp corrections when oversupply appears. Future volatility will likely continue as the market adjusts to lumpy project deliveries, shifts in recycling availability and rapid changes in battery manufacturing plans. Strategic inventories, contractual terms between miners and battery producers, and the degree of vertical integration along the supply chain will moderate or amplify these oscillations.

Demand detail: where and how lithium carbonate is used

Lithium carbonate finds use in multiple battery chemistries, notably in nickel-rich cathodes (often converted to lithium hydroxide for NMC/NCMA production) and in certain lithium iron phosphate (LFP) manufacturing processes where carbonate is a direct input. The rise of LFP—favored for price, safety and cycle life in many EV segments and stationary storage—creates both opportunities and competition with nickel-rich chemistries. Regional preferences matter: China’s broad adoption of LFP has reduced reliance on hydroxide in that market, while Europe and North America historically leaned toward nickel-rich chemistries but are increasingly diversifying.

Other industrial uses—glass and ceramics, pharmaceuticals, and air treatment—represent a small but stable baseline for lithium carbonate demand. However, battery demand remains the determinative factor for long-term trajectory.

Supply detail: mining, refining and capacity constraints

Brine operations (Chile, Argentina, Bolivia) are attractive for low operating costs but require long evaporation periods and face environmental scrutiny, especially concerning water usage. Hard-rock spodumene (Australia) can be ramped faster and has attracted major investment, but it requires conversion to carbonate or hydroxide at refineries—a step often concentrated in China. This concentration of refining capacity creates strategic dependencies and has led consuming regions to push for more domestic or allied refining capacity.

Key supply challenges include:

- Long lead times and permitting delays for greenfield projects.

- Upstream-to-midstream bottlenecks: refineries must expand in step with mined ore supply to prevent logjams of concentrates.

- Water and environmental constraints limiting expansion of some brine projects.

- Capital intensity and returns that influence investor appetite, especially after past cycles of overinvestment.

Technological evolution and substitution risks

Battery technology is moving fast. Incremental improvements in lithium-ion cell chemistry (higher nickel content, silicon anodes, cathode coatings) affect the quantity and type of lithium chemicals needed per kWh. Meanwhile, next-generation technologies—such as solid-state batteries or sodium-ion systems—pose substitution risks over a longer horizon. However, widespread commercial adoption of fully lithium-free alternatives is unlikely within the next decade given the massive incumbent manufacturing base and the performance advantages lithium-based systems still provide.

The distinction between lithium carbonate and lithium hydroxide matters. Hydroxide is often preferred for high-nickel cathodes due to improved cathode synthesis outcomes, while carbonate remains suitable for LFP and some NMC formulations after conversion. Technological advances in direct precursor synthesis, cathode processing and recycling can alter the balance between carbonate and hydroxide demand. For example, more efficient conversion technologies or on-site refining at cathode plants could reduce the need to import finished chemicals.

Geopolitics, sustainability and the role of recycling

Geopolitical factors are increasingly shaping the market. A small number of countries control significant shares of mining, refining and battery manufacturing, and governments are implementing policies to secure domestic supply chains. Trade measures, incentives for local processing, and strategic stockpiling are all possible tools that can reshape flows and pricing. The prominence of China in refining capacity has prompted competitors in Europe, North America and Japan to subsidize new processing facilities closer to end markets.

Sustainability and environmental, social and governance (ESG) considerations are central. Brine projects’ water impacts, tailings management at hard-rock operations, and the carbon intensity of extraction and refining are under scrutiny from regulators, financiers and civil society. Projects that can demonstrate lower environmental impact and strong community engagement will likely face fewer delays and secure long-term offtake agreements.

Recycling will play a growing role but is not a near-term panacea. Mechanical and hydrometallurgical recycling can supply increasing volumes of lithium, cobalt and nickel as end-of-life batteries return to the market. However, the lag between battery deployment and end-of-life recovery means recycled lithium will supplement rather than replace primary supply in the coming decade. Improvements in collection systems, standardized cell designs and more efficient recovery processes will accelerate the contribution of recycling over time.

Investment, market structure and business models

Investor sentiment in the lithium space cycles between exuberance and caution. Long-term stable returns require careful management of project risk, environmental approvals and downstream offtake. Several structural trends are noteworthy:

- Vertical integration: battery makers and OEMs increasingly seek stakes in upstream supply or direct long-term contracts to secure feedstock.

- Refinery build-out: countries and corporations are investing in conversion capacity to reduce dependency on concentrated refining hubs.

- Financial instruments: long-term purchase agreements, pricing formulas indexed to battery-grade benchmarks, and hedging strategies will multiply as the market matures.

These shifts change bargaining power along the value chain and influence how price signals are transmitted from miners to end-users.

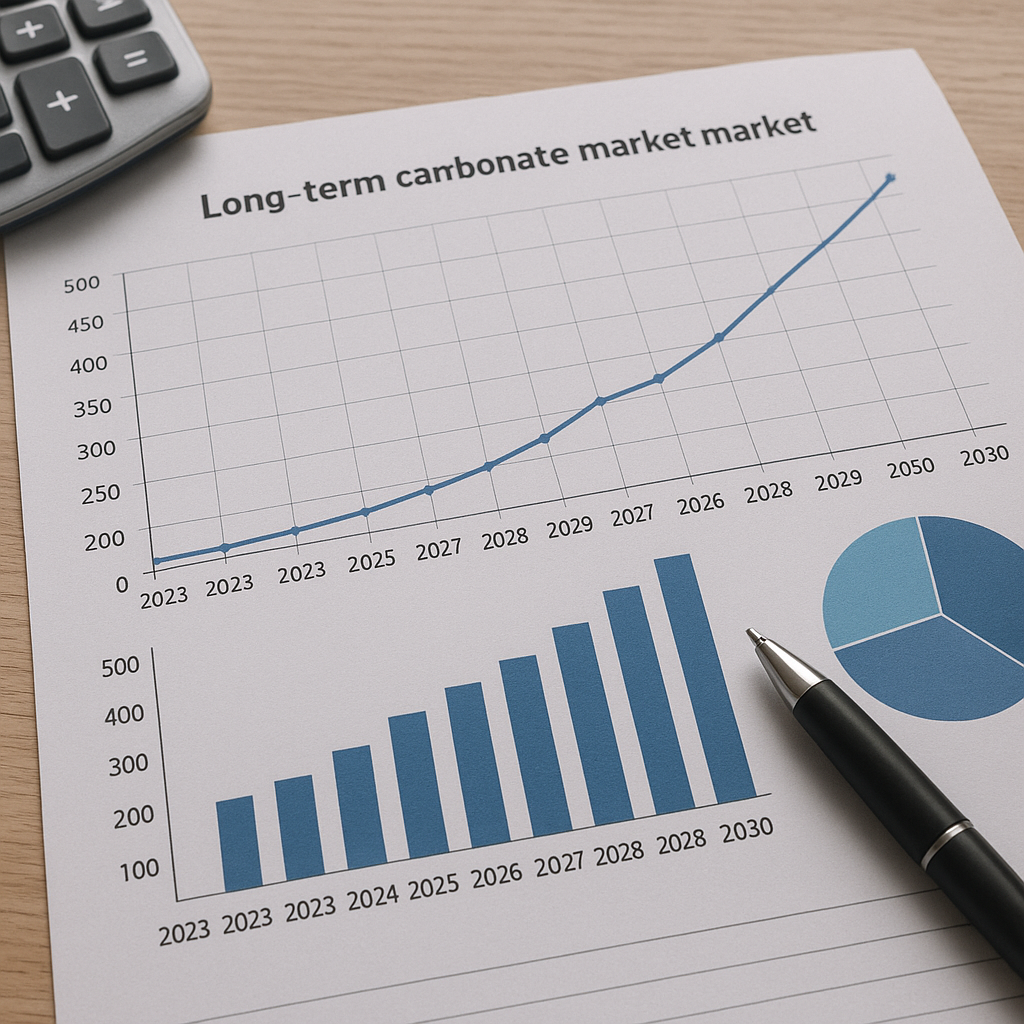

Price outlook and plausible scenarios

Forecasting exact prices is fraught given the market’s history of rapid swings. However, a few scenarios illustrate potential long-term outcomes:

- Baseload growth with contained volatility: Strong policy support for EVs and storage, steady project execution and accelerating recycling deliver robust demand matched by disciplined investment. Prices trend moderately upward with periodic temporary spikes during tight phases.

- Oversupply and consolidation: A wave of new mines and refineries brings capacity forward faster than demand increases, driving a multi-year period of lower prices, consolidation among producers and renegotiation of contract terms.

- Tight market with strategic constraints: Permitting delays, environmental pushback and geopolitical restrictions limit new supply. Rapid adoption of EVs or a surge in grid storage causes acute shortages and high prices, prompting accelerated investment and potential substitution pressures.

Which path unfolds depends on policy choices, the pace of EV adoption, the agility of supply chains, and technological developments in batteries and recycling. Strategic government interventions—such as incentives for domestic refining or strict ESG standards—can tilt outcomes toward regionalized supply chains and potentially higher costs for consumers but lower systemic risk.

Key risks and indicators to watch

Market participants should monitor several indicators that presage future shifts:

- Permitting timelines and social license developments for major brine projects and hard-rock mines.

- Refinery build-out outside traditional hubs and the emergence of new refining technologies.

- Battery industry adoption rates for LFP versus nickel-rich chemistries and the pace of any shift toward alternative chemistries.

- Policy measures affecting EV subsidies, carbon pricing, and strategic stockpiling.

- Advances in recycling technologies and the scale-up of battery collection networks.

Investors and manufacturers that keep close watch on these indicators will be better positioned to adjust supply contracts, capital allocation and R&D priorities as the market evolves.

Implications for stakeholders

For miners and project developers, the message is clear: secure robust community engagement, prioritize low-impact operations and coordinate with refineries to ensure offtake. Battery producers and OEMs should hedge exposure by diversifying suppliers, investing in recycling, and supporting domestic processing capacity. Policymakers need to balance rapid deployment incentives with environmental safeguards to avoid long-term social and ecological costs that could obstruct future projects. End consumers and utilities will face prices shaped by these upstream decisions, but increased scale and competition can also make storage and electric transport more accessible over time.

The evolving market for lithium carbonate will remain dynamic. While demand growth is likely to sustain long-term interest in lithium, outcomes will vary by region, technology path and the effectiveness of recycling and supply-chain integration. Stakeholders who combine strategic foresight with operational flexibility and strong ESG performance will navigate the market most successfully.